With the impending arrival of Kevin De Bruyne, likely to cost them $91m making him the second most expensive arrival in league history, Man City would have forked out a stratospheric $221m in transfer fees this period. That figure is partially offset by player sales of $75m for a still astonishing net spend of $146m. Last season, City spent $108m and before that, $130m. All told, City’s net spending (if De Bruyne is included) totals $930m since Sheikh Mansour Ali Nahyan’s takeover in 2008.

Return to profitability:

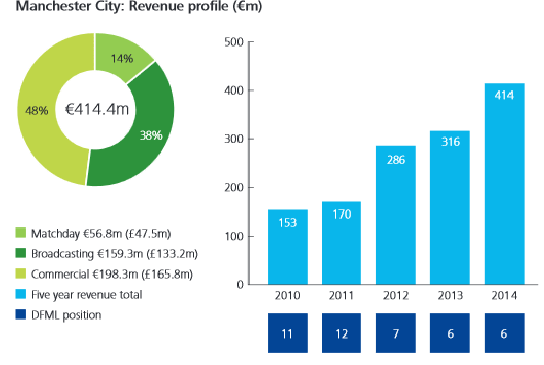

Surely, the sting of a $24m fine paid to UEFA for breaches of Financial Fair Play rules in 2012 would make them wary of testing those waters again. However, the reality is that this is no longer the Man City of yore. Deloitte’s Money League published early this year ranked City sixth in revenue for the 2013-2014 season with only Real Madrid, Man Utd, Bayern Munich, Barcelona, PSG ahead of them. Amongst all clubs, City had the strongest growth in the top 10, surging from the 2012-2013 figure of $355m a year later to $466m, an increase of 28%. With such positive numbers, the loss of $35m in the 2013-2014 FY (the last year for which accounts are available) was more than halved from the $80m posted the year before, a growth of 28%.

Reason for optimism: Eye popping TV money windfall

The boost to City’s coffers was primarily fueled by the vastly improved TV money deal which runs from 2013-2016. Receipts from TV proceeds netted City $150m from domestic as well as overseas distribution of broadcast rights. In addition, City was paid $56m for his Champions league appearances. All told, City gained $206m from it’s league and CL appearances. Guess what? That is going to be dwarved by the gargantuan TV deal redrawn for the 2016-2019 years, which will see $12.7bn (domestic + projected overseas revenue) divided between the 20 PL clubs with City expected to receive $230m every year and depending on CL progression the figure could rise to $300-$340m.

City’s strength: Commercial revenue

City has also boosted its commercial stream significantly, now just behind Man Utd with $256m in revenue. The club’s brand is being aggressively monetized with the formation of the City Football Group and investments in Melbourne FC, NYCFC, and Yokohama Marinos. The Abu Dhabi based ownership has also inked new five year deals with Etihad, Nissan and Hays. City’s owners close links to Etihad were subject to close scrutiny with the gulf based airlines locking at a very propitious time, a $616m contract for the next decade including stadium naming rights, shirt sponsorship, and football campus which adds a convenient $61m annually to FFP mitigation. That figure is expected to rise again with Etihad’s improved sponsorship deal which will net an additional $493m for an additional five years. In terms of percentage, City’s 48% share of commercial revenue tops the Premier League. No wonder, Khaldoon Mubarak, City’s CEO with a wink in his eye stated, “commercial success has never been an afterthought for Manchester City.”

Weakest link: Matchday receipts

The club’s match day receipts suffer relative to Man Utd and Arsenal. Just $74m generated compared to over $150m for their rivals. However, this stream could see much improvement with the Etihad increasing seat capacity to 55,000 this season and in the near future to 61,000. Season ticket prices are still the lowest in the league and capped at $461 but the high end has almost doubled from $1370 to $2698. City, a late entrant to pre-season touring has made a summer fixture in recent years with regular participation in the International Champions Cup. Such summer tours net Man Utd about $25m. In fact, Utd strategy was a shrewd response to the anticipated shortfall in revenues from the loss of CL participation.

Other factors: Wage trimming and back room attrition

In a creative accounting trick, City shifted more than a hundred employees to the City Football Group and restaffed using third party agencies. One of the biggest stumbling blocks is City’s wage bill, second highest in the world with only Man Utd spending more. However, recent pro-active measures have actually resulted in the wage bill falling from $360m to $313m. But this might not carry forward with the wage demands of Raheem Sterling and Kevin De Bruyne offsetting the wage reductions from pruning the squad.

On the books, transfers can be amortized (year to year) without entering the full amount. City would not be making such expensive transfers without the padding provided by the TV money windfall, huge commercial potential, and clearing wages. Even something perceived as small like a strong pound relative to the euro can make a huge impact, i.e., fewer pounds paid for transfers bringing down amortization costs.

For a more in-depth look at Man City’s state of finances, please go to the excellent The Swiss Ramble.